Spain – the land of unlimited entrepreneurial opportunities? Indeed! Starting a business in Spain can be a smart business move.

In this guide, we explain the advantages Spain offers as a business location, the legal forms available, and what you need to pay attention to when starting a business.

Content

- Who can start a business in Spain?

- What are the advantages of starting a company in Spain?

- What legal forms are available?

- How to start a business in Spain

- Starting a company in Spain is worth it

Who can start a business in Spain?

Sunny climate, strategic location, and a booming economic environment – Spain is attracting more and more entrepreneurs.

In principle, the door to starting a business in Spain is open to everyone. Whether you are an EU citizen, a non-EU citizen, or a Spanish national – anyone who meets the basic requirements can establish a business in the country. However, there are some formal requirements to consider, which may vary depending on your country of origin.

EU Citizens: Simple conditions for market entry

For European Union citizens, starting a business in Spain is straightforward. You only need a Spanish tax identification number for foreigners, known as the Número de Identificación de Extranjeros (NIE).

Additionally, registration with the relevant authorities is required, but this can be done without any difficulty.

Non-EU Citizens: Additional hurdles

In principle, non-EU citizens can set up a company in Spain with a tourist visa. A NIE number is only required for the registration and enrollment of the company. However, this only allows you to set up your own company in Spain, not to work there.

For innovative business models, the so-called entrepreneur visa is particularly suitable in such cases. This visa is aimed at founders who wish to operate in the technology sector or other forward-looking industries.

For innovative business models, the so-called entrepreneur visa is particularly suitable in such cases. This visa is aimed at founders who wish to operate in the technology sector or other forward-looking industries.

For less innovative business ideas, such as opening a restaurant or retail store, the visa for self-employment is the standard option. This is a regular work permit that allows you to run your business in Spain without needing to demonstrate special innovation potential.

For investors and wealthy individuals, there is also the possibility of obtaining a permanent residence permit, and eventually even Spanish citizenship, through the Golden Visa program. To qualify for a Golden Visa, you must either purchase real estate worth at least €500,000, buy shares in Spanish companies worth €1,000,000, or deposit €1,000,000 in a Spanish bank account.

What are the advantages of starting a company in Spain?

Spain is attractive not only for its high quality of life but also for its numerous economic benefits for entrepreneurs. Those who wish to start a company in Spain can take advantage of many factors that make the country an ideal location for business ventures.

Strategic location and access to the European Market

Spain serves as a bridge between Europe, Africa, and Latin America. With its strategic location, the country offers companies direct access to important markets. Spain is an ideal starting point, especially for firms looking to expand into the Latin American market.

Favorable business environment

The economic environment in Spain has significantly improved in recent years. Tax rates are moderate compared to other European countries, and there are various incentives and support programs that are particularly attractive for foreign investors, entrepreneurs, and employees.

Of particular note in this context is the so-called Lex Beckham: This law allows individuals, under certain conditions, to avoid Spain’s progressive tax rates and instead tax their income at a favorable flat rate of just 24%.

Choice between different legal forms

In Spain, you can choose from various legal forms that allow you to structure your company flexibly according to your needs. The most common forms are the Sociedad Limitada (SL) and the Sociedad Anónima (SA). Both provide a solid foundation for building a successful business.

Highly qualified workforce

Another advantage of starting a company in Spain is access to a large pool of highly qualified workers. Spain has excellent universities and training institutions that produce a significant number of skilled professionals each year. Particularly in the fields of technology, IT, and engineering, companies in Spain can find well-trained personnel.

Quality of life and cultural diversity

Finally, Spain offers a high quality of life, which attracts both entrepreneurs and international talent. With its warm climate, rich culture, and excellent healthcare services, Spain is a place where people are happy to settle and work.

What legal forms are available?

Regardless of nationality, anyone who wants to start a company in Spain must choose an appropriate legal form for their business. This decision affects liability, the required start-up capital, and the tax obligations that will apply.

Sociedad Limitada (S.L.)

The Sociedad Limitada (S.L.) is the most popular legal form in Spain and is roughly equivalent to the British ‘LTD’ or American LLC. This form is ideal for small and medium-sized enterprises. The minimum share capital is €3,000, a relatively low amount in the European context. Liability is limited to the company’s assets, protecting the personal assets of the shareholders.

If there is only one shareholder, it is referred to as a Sociedad de la responsabilidad limitada unipersonal or S.L.U.

Sociedad Anónima (S.A.)

The Sociedad Anónima (S.A.) is comparable to the American corporation, in which owners have shares. This legal form is particularly suitable for larger companies or for projects where external capital is to be raised through the issuance of shares. The minimum share capital is €65,000, of which at least 25% must be paid in at the time of incorporation. Liability is limited to the company’s assets, making it attractive to investors. This form also offers the possibility of publicly trading shares, making it especially interesting for high-growth companies.

Empresario Individual (Autónomo)

The Empresario Individual, better known in Spain as Autónomo, is the most common legal form for sole proprietors and freelancers.

The main advantage of this legal form is its simplicity: no minimum capital is required, and the formation can be quick and easy.

However, this legal form is subject to the private income tax rate of up to 47%. Another significant disadvantage of the Autónomo is the unlimited liability, meaning the entrepreneur is personally liable with all their private assets for the company’s debts.

This can pose a substantial risk in the event of financial difficulties. Therefore, it is advisable to choose this legal form only when the business activities are manageable and the risks are low.

Sociedad Civil (S.C.)

The Sociedad Civil (S.C.) is the Spanish equivalent of a special form of the LLC in the US, where at least two people act as partners. Each partner is fully and jointly liable for all their personal assets.

No minimum capital is required to form an S.C., making this form particularly attractive for businesses that require little start-up capital. However, this flexibility comes with a high personal risk. Since all partners are equally liable for the company’s obligations, a high level of trust between the partners is essential.

How to start a business in Spain

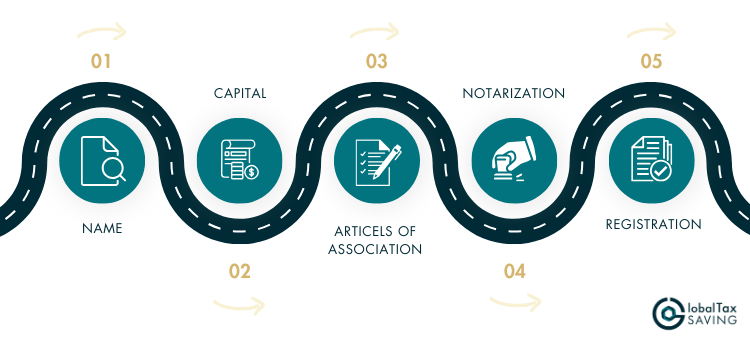

Once you have met all the requirements, you can begin the process of establishing your business. The process of setting up an SL (the most common form of business) typically involves the following steps:

1. Name verification and reservation

The first step in establishing a business is to verify and reserve the desired company name with the Registro Mercantil Central (Central Commercial Register). The name should be unique and must not create confusion with existing companies.

After approval, the name is reserved for six months. However, if the company is not notarized within the first three months, the reservation must be renewed. Be sure to register the name in time and not miss the deadline for notarization.

2. Deposit of Share Capital

Once the name has been reserved, the required share capital of at least EUR 3,000 must either be paid into a business account at a Spanish bank or made available to the company in the form of a contribution in kind.

3. Drafting the articles of association

The next step is to draft the company’s Articles of Association. These outline the internal rules of the company, including the name, business purpose, registered office, share capital, and profit distribution. These statutes form the legal backbone of the company and must be precisely and clearly formulated.

It is advisable to have the Articles of Association reviewed by an expert to avoid future conflicts or misunderstandings. Faulty or unclear formulations can lead to legal issues.

4. Public Notarization

With all the required documents and the drafted Articles of Association, the next step is to visit the notary to officially establish the SL. After reviewing the documents, the notary will create a public deed of incorporation. This step makes the company legally binding.

5. Registration with the Tax Office

After notarization, the company must be registered with the Spanish Tax Office (Agencia Tributaria) to obtain a provisional tax identification number (NIF).

Starting a company in Spain is worth it

Starting a company in Spain is often an economically wise decision. However, unfamiliar legal requirements, language barriers, and cultural differences can be stressful along the way to establishing a business.

If you’re considering starting a business in Spain, you can make the process much easier with professional support. At Global Tax Saving, we bring 30 years of experience and make the entire incorporation process smoother for you. We take care of the tedious bureaucracy, assist with selecting and registering the appropriate legal form, and ensure a successful start for your company.

Contact us today for an initial consultation.